How to Buy Business Liability Insurance

How to Buy Business Liability Insurance

Liability Insurance

If you have been considering starting an Insurance business of your own. there are some considerations that need to be addressed before you make a final decision on what type of business you will open.

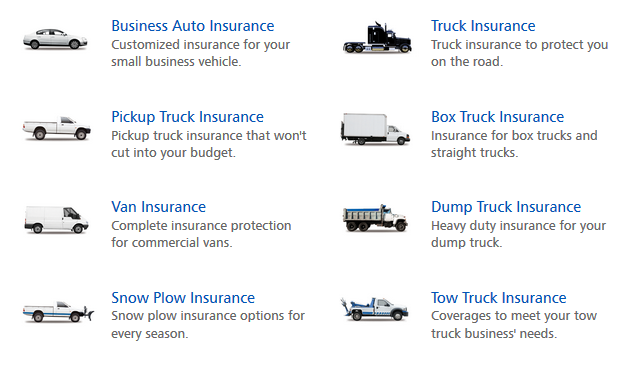

If you have been considering starting an Insurance business of your own. there are some considerations that need to be addressed before you make a final decision on what type of business you will open. What is commercial auto insurance? Many business vehicles may encompass a far broader array, from your personal car to the big trucks used by your construction firm and more: Trucks. Other vehicles, such as recreational vehicles, and boats may be underwritten differently than other types of vehicle. Each of these points is important when making your final decision about what kind of insurance to offer in your business.

Buy Business Liability Insurance

Property insurance is primarily needed. if you are insuring the physical building you use as well as any land that may be owned by your business. If you are insuring just one portion of the property, such as your garage, you will not need property insurance. However, you will probably want to include bodily injury liability coverage, and/or vehicle damage liability coverage, if you are offering repairs to another person’s property or their vehicle. If your business is offering replacement value of personal items or similar services, you should also consider collision damage waiver (CDW) coverage. If you are carrying only one non-owner policy. You can usually get away with just adding the customary nonsuit forms, but you should always check with the agent to be sure.

Different polices cover different things. Most business owners either choose to add riders to their general liability policies, or they simply purchase policies that explicitly state what is covered. Some policies cover property damage or bodily injury while operating a vehicle. Others cover business owners’ personal liability for negligence or errors and omissions. Still others have both collision damage waiver and general liability coverage. Which protects a business owner for both property damage and bodily injury.

Every state requires business owners to carry minimum amounts of liability insurance, but some also allow business owners to select higher limits of liability coverage. Generally, the higher your limit of liability auto coverage, the lower your premium will be. A standard deductible may also help keep your premiums down. For example, a person who pays his own deductible for a vehicle insurance policy will be able to pay out-of-pocket expenses related to an accident or collision with another motorist even if the other driver has no or very minimal medical insurance.

Liability coverage

includes the replacement cost of your vehicles in the event of total loss or theft. This type of insurance coverage may also include personal injury protection. Which pays your legal costs in the event that you are sued by a party whose property you damage. Some states require a minimal amount of uninsured/underinsured motorist coverage. Which pays the balance of your liability and limits the amount of payments you must pay as the result of an accident or injury to someone else. If you own multiple vehicles, you may want to consider obtaining uninsured/underinsured motorist coverage for each vehicle.

Collision coverage pays for repairs to your vehicles caused by collisions with other vehicles. And pays your legal costs in the event you are sued for damages. It is often called “umbrella” coverage because it will partially replace your liability insurance. The portion of your premiums that will be dedicated to paying for collision defense costs will be based on a percentage of the actual market value of the vehicle you are paying to repair.

Liability Insurance

If you require to carry either uninsured or underinsured motorist coverage on your business vehicles. You will also need to carry liability insurance to protect your business assets. And the investments you have made in them. This type of coverage can vary greatly among different states. So business owners should always shop around before deciding on a particular provider. While many companies offer liability insurance for auto drivers, liquor liability insurance not covered at all times.

The decision about whether to purchase insurance for your business vehicles. Should be made after carefully examining each type of coverage .And how it will affect your bottom line.

A good insurance policy can provide a significant boost to your bottom line. To learn more about how to decide which type of insurance coverage is right for your business. Contact an insurance agent today. They can help you decide what type of insurance is right for your situation. And answer any questions you may have. The insurance industry is very competitive. And the right policy can save you a significant amount of money on your business insurance premiums.